In this post I’ll explain in detail what are Gann fans, How they’re calculated, How to use them in your trading. I’ll provide a simple Gann fan trading strategy also show you how to use the Gann fan indicator using Tradingview.

I’ll also explain the CORRECT method for placing Gann fans on your charts. There seems to be a lot of misunderstanding about applying this tool. In this post I show you the correct method.

What Are Gann Fans?

Created by W.D. Gann, Gann Fan is a technical analysis tool that is based on the theory that movements in price follow geometric angles.

The tool, drawn from a trend reversal point, consists of nine diagonal lines called Gann angles. It is drawn at 45 degrees where time and prices are divided proportionally at a uniform rate of speed (rate of change). The Gann angles are visually spread out like a fan; hence the name Gann Fans.

One of the main goals of Gann Fans is to measure the slope or degree of the ascent or descent of price movement using the Gann angles to predict future price movement.

TradingView, a free charting platform, offers Gann Fan tools for free. See the ‘How to Use the Gann Fan Indicator’ section below.

Signup for a Essential, Plus or Premium TradingView subscription using the link. *New users get $15 towards a new plan.

Signup for a Essential, Plus+ or Premium TradingView subscription using the link. *New users get $15 towards a new plan.

How to Calculate Gann Fans?

W.D. Gann’s indicators and theories are mathematically based. Gann Fans, use proportions of time and price to calculate an angle.

Ratios are calculated from time and price units. For example the 82.5 degree angle is calculated from 1/8 ratio of time and price. That is, on a daily price bar chart a line is plotted from the horizontal with a gradient of 1 day unit of time against $8 unit of price (or other appropriate pricing scale).

The table below summaries the nine ratios used to create a Gann Fan.

| Time / Price | Fan angle (in degrees) |

| 1/8 | 82.5 |

| 1/4 | 75 |

| 1/3 | 71.25 |

| 1/2 | 63.75 |

| 1/1 | 45 |

| 2/1 | 26.25 |

| 3/1 | 18.75 |

| 4/1 | 15 |

| 8/1 | 7.5 |

If you are interested in learning more about Gann Fans and Gann’s theories and methodologies, consider reading the following materials:

How do Gann Fans Work?

Gann Fans draw diagonal lines surrounding the primary indicator 45-degree angle line or the 1/1 line.

The fan comprises nine diagonal lines with the 45-degree angle line acting as the center line, while the other eight will be located below or above this line.

As a whole, the line angles in the Gann Fan works as a:

- Support and resistance

Fan lines are primarily used as support and resistances levels and areas.

On an uptrend, lines above the central 45-degree, are typically regarded as resistance lines. Lines below the 45 degree line are typically considered as support lines. The reverse is true for downtrends.

- Strength gauge of price moves

Gann Fan measures trend strength. The strength (or weakness) of a price move, is gauged with respect to the areas of the fan that price is trading.

More on this on the next subsection Reading a Gann Fan: Example.

- Predictive or price forecasting element

The tool can be used to help identify trends and forecast future prices.

- Sentiment gauge

A bearish sentiment is typically considered when price stays below the 45 degree line in a downtrend. When price stays above the 45 degree line on an uptrend the sentiment is considered bullish.

Reading a Gann Fan: Example

Let’s look at the way the tool works using a chart example.

The tool projects 9 lines from a selected significant high or low, selected by the trader. This point has been identified as the start of an up or down trend.

The 1/1 line (drawn light blue) acts as the 45-degree center line.

The lines below the 1/1 line (1/2, 1/3, 1/4, and 1/8) are considered progressively more bearish. Those above the 1/1 line (2/1, 3/1, 4/1, 8/1) progressively more bullish.

Each of the Fan lines can be interpreted by the trader as potential support or resistance area depending on where in the fan price is trading.

Gann Fan Trading Strategy: Example

A common buy strategy is using resistance breaks and support bounces for entry.

When a Gann Fan is drawn on an established downtrend. Use the 1/1 diagonal line to gauge if price downtrend is slowing – Establish if price has found support and is it trading above the 1/1 line.

When the price breaks above the 2/1 resistance line, consider this a bullish signal, and look at an opportunity for entry. Either aggressively on the break or alternatively wait and look for price to retrace after the break to find support in the same area.

See sample below:

How to Use the Gann Fan Indicator?

In the previous sections I’ve provided some examples of how Gann fans can be used to interpret price movement, market sentiment and identifying potential reversals.

Gann Fan is most effective when used in trending environments and like most tool and indicators it’s interpretation requires a certain amount of trader discretion.

Its effectiveness depends on picking high / low trend reversal points. Precise and proper scaling is also very important. I’ll discuss this below.

In the following sections I’ll explain how to draw a Gann fan using Tradingview.

How do I use Gann Fan in TradingView?

Gann Fan is free to all TradingView users. All the indicator examples in this post were created using TradingView.

To signup for a 30 day free Tradingview trial click the link. Alternatively…

Signup for a Essential, Plus or Premium TradingView subscription using the link. *New users get $15 towards a new plan.

Signup for a Essential, Plus+ or Premium TradingView subscription using the link. *New users get $15 towards a new plan.

How do I draw a Gann Fan on TradingView?

Proper scaling is critical when using the tool!

This is something that’s commonly done incorrectly and if done wrong will make the tool pretty much useless.

Remember the principles discussed above? Each line represents a ratio of time and price units. The 45 degree line represents 1 unit of price movement with 1 unit of time.

Simply drawing a trend angle at 45 degrees on he chart is completely wrong!

Below is the correct method for placing a Gann fan on your chart.

Scaling

Before placing the Gann fan on the chart you’ll need to establish the 45 degree line. To do this we need to use the Gann Box tool.

Placing the Gann Box tool

Step 1 : Open TradingView chart

Step 2: Change chart time frame to the time you want to do your analysis. I like to do this on the Daily time frame.

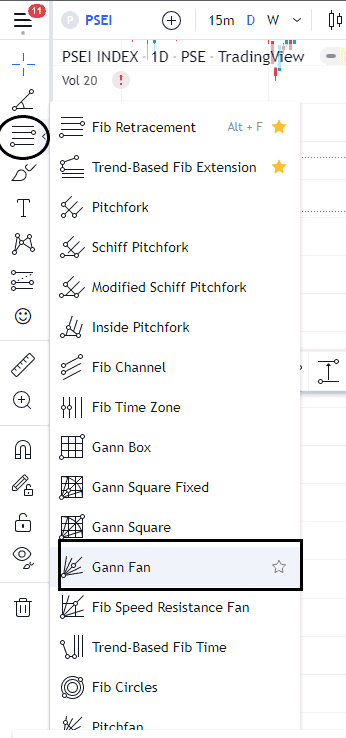

Step 3: On the the left panel, select Gann and Fibonacci Tools See circle below

then click on Gann Box See box below

Step 4: Select and click the reversal point. A good Idea is to use the magnet tool (left tool bar) to precisely pick the extreme high or low point.

Step 4.1: Extend the Gann Box upwards to another high or low point. Use the magnet tool again to precisely pick the extreme high or low.

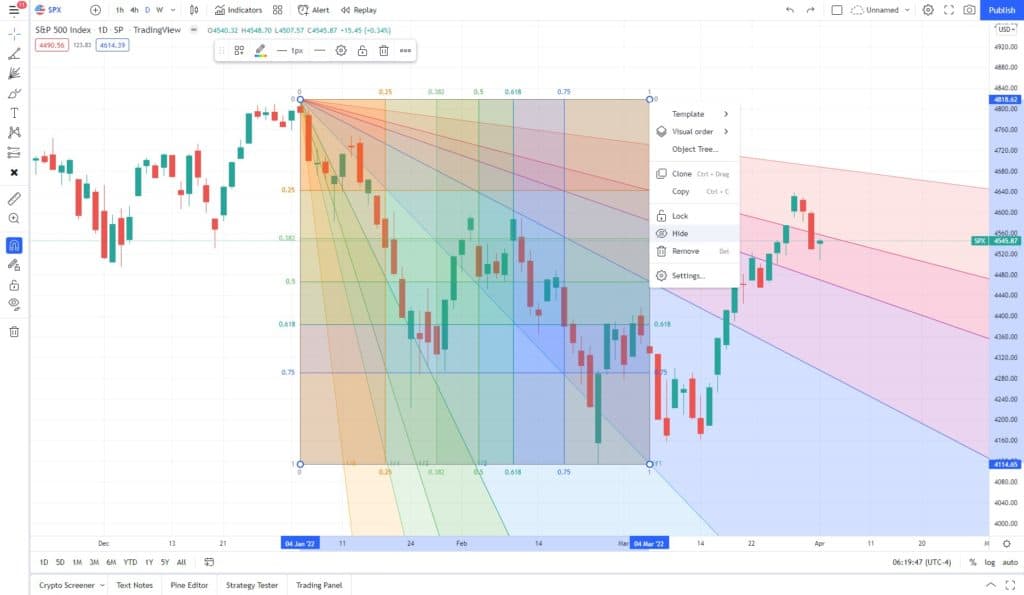

Sample below is Gann Box drawn on a downtrend

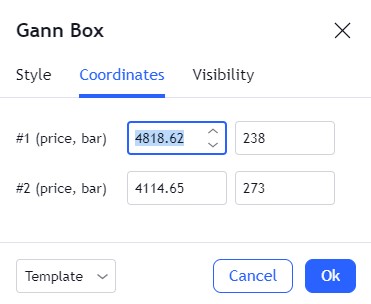

Step 5: Scale the Gann Box: To do this open settings for the Gann box by hovering over the drawing > right click > then select settings.

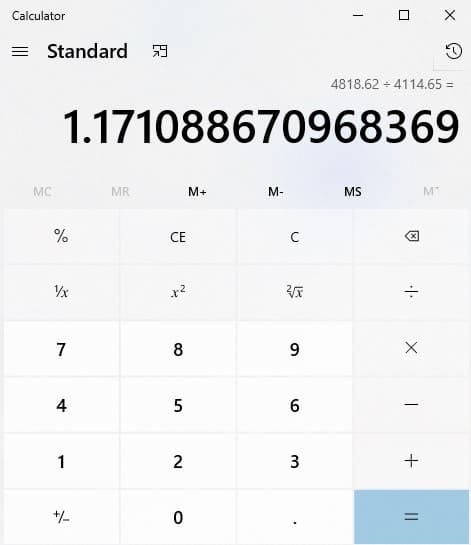

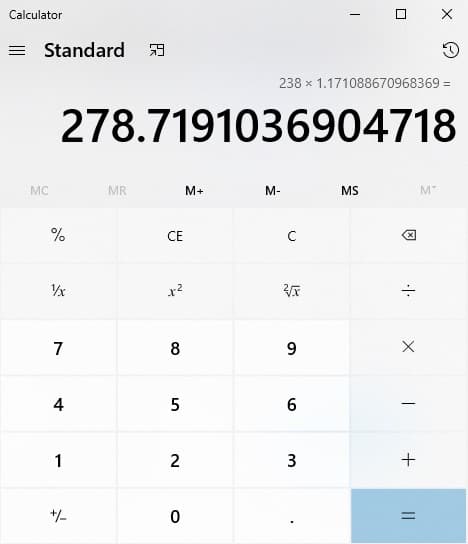

Step 5.1: To scale the Gann box correctly we want the price and time ratio to be 1:1. Therefore we need to do a simple ratio calculation to proportion the Gann Box correctly.

In the above example the coordinates of the Gann box are listed. In the first column is price in the second column is time (bar).

To proportion price and time. First divide point #1 price by #2.

Next for an uptrend divide point #1 bar by that result. For a downtrend multiply point #1 by that result.

Replace the point #2 bar box number with this result.

We will now use this Gann box to align the Gann Fan for best precision.

Drawing the Gann Fan

Step 6: Apply Gann Fan

Step 6.1: On the drawing tools panel, click Gann and Fibonacci Tools See circle below

Select ‘Gann Fan’ See box below

Step 6.2: To apply the fan to your chart start by selecting the original reversal point (corner of the Gann box). Use the magnet tool again to get the precise point.

Step 6.3: Extend the 45 degree line to the opposite corner of the Gann box. Use the magnet tool to get a perfect corner to corner fit.

Step 6.4: If you prefer a cleaner looking chart a good idea s to hide the Gann box since it’s no longer required. Hover over the Gann box > Right click > select ‘Hide”

All nine diagonal lines of the Gann Fan are now placed on the chart.

Step 6.5: Lock tool in place. Since the precise location of the Gann fan is so important. It’s a good idea to lock the tool in place. To do this hover over the Gann fan > Right click > select ‘Lock”

Where Can I Trade With Gann Fans?

TradingView is an excellent starting point for trading with Gann Fans. It’s made simple and intuitive. if you are interested in signing up for a 30 day free tradingview trial click the link.

TradingView’s can be used to trade stocks, futures, cryptocurrencies, and forex directly from the chart using selected brokers.

For a complete list of Brokers that support Tradingview integration click the link. To find out more about connecting a brokerage account to Tradingview check out my previous post. How to connect a broker to Tradingview.

Signup for a Essential, Plus or Premium TradingView subscription using the link. *New users get $15 towards a new plan.

Signup for a Essential, Plus+ or Premium TradingView subscription using the link. *New users get $15 towards a new plan.

How do you trade with Gann Fan?

Gann Fan trading strategies primarily use the nine diagonal lines as 1. Support and resistance areas. 2. Help determine bullish or bearish trend sentiment. 3. Forecast future price movement and 4. Give an indication of the strength of a move.

To learn a simple trading strategy check out the section above ‘Gann Fan Trading Strategy: Example’ above.

To find out more about trading with Gann Fan’s check out the following books:

Limitations of Using the Gann Fan

It’s important to know the limitations of the tool before you consider adding it to your technical analysis toolkit.

Here are some of those limitations:

- Proper scale is critical

The tool requires precise placement. The calculations are based primarily on geometric angles.

Improper scaling will result in inaccurate angles and misplaced support/resistance lines.

There seems to be a lot of mis-information about how to correctly scale the tool. To correctly scale your Gann fan check out the ‘How to Use the Gann Fan Indicator’ section above.

- It shouldn’t be a stand alone tool

The tool is typically employed as part of a discretionary trading strategy. The tool should be used in combination will a solid understanding or price movement and behavior.